tax on forex trading nz

Currently New Zealand is considered as a safe haven for forex brokers. Flick me a message Id easier.

Eurozone February Flash Pmi And Potential For Recovery Orbex Forex Trading Blog In 2022 Fundamental Analysis Daniel Johns Fundamental

Working out if youre in the business of trading in cryptoassets.

. Open Free demo account in 5 seconds. Tax On Forex Trading Nz The Ird Says People Should Consider Money Made Selling Future Of Tax Interim Report Html The Tax Working Group Australian Tax Implications Of Forex Gains Losses Forex Factory. This website uses cookies to give Tax On Forex Trading Nz you the best online experience.

Ad Prestigious foundation for 20 year. Give Your Loved Ones a Copy Of Our Magazine and Avail Subscription Deals. Australian Tax As one mentioned its the same here it depends on how often you trade.

This website uses cookies. Is my gain from foreign currency trading counted as capital gain. Find out more in our article.

Tax on forex trading nz. Encuentra millones de productos. Tax On Forex Trading Nz Online Currency Trading Platform.

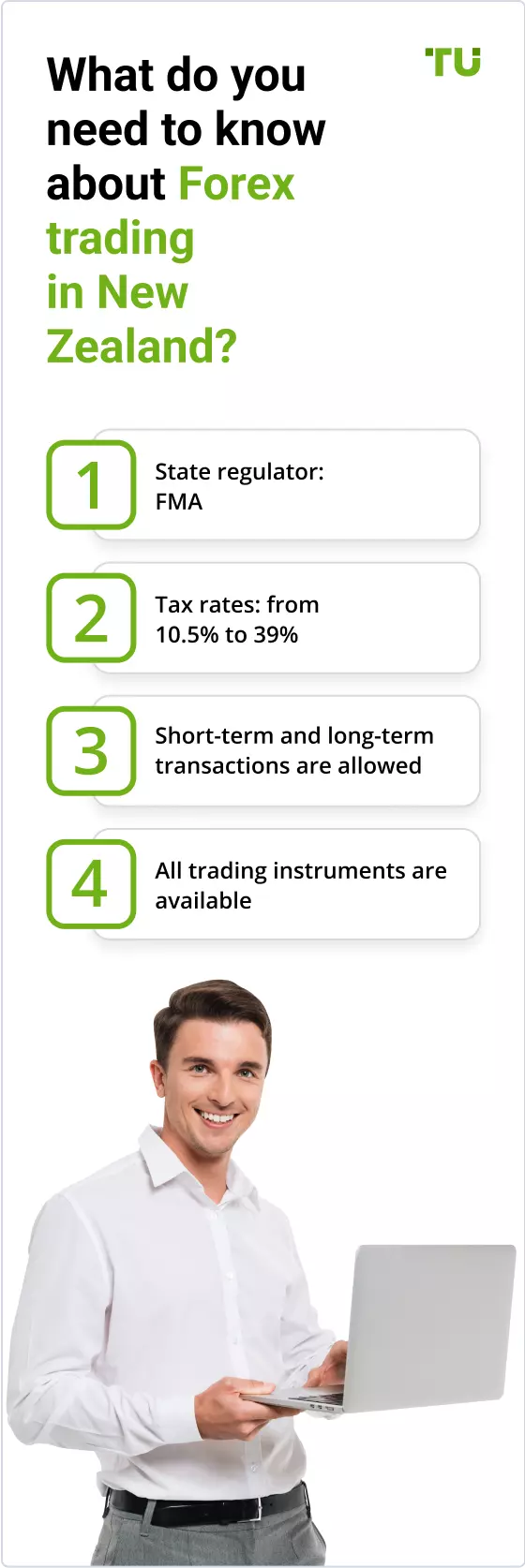

Ad Envío gratis con Amazon Prime. Traders are required to pay tax on their income of up to 33c in the dollar. Forex futures and options are 1256 contracts and taxed.

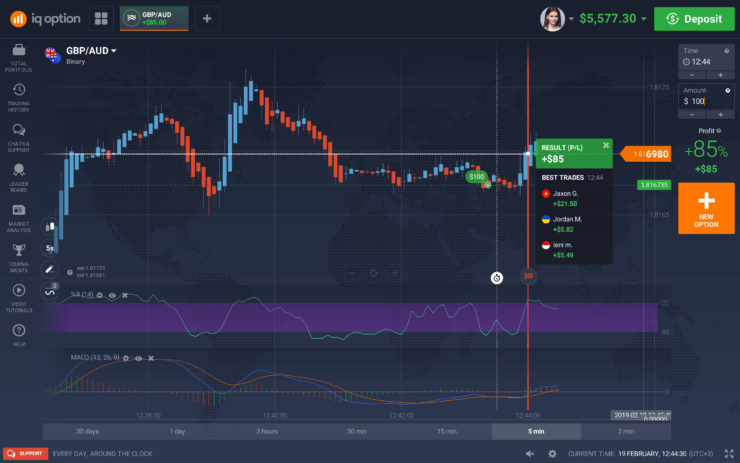

Ad Get In-depth News Coverage Of Business Technology Culture Economy and the World. If your total income is. Forex trading is the buying and selling of foreign currencies.

Please let us know if you agree by clicking on the Accept option below. Once the seminar finished about a dozen people handed over their credit cards for a 5995 two-day forex training course a special price reduced from the usual 12000. Ad Get In-depth News Coverage Of Business Technology Culture Economy and the World.

Direct tax is income tax that is imposed on the profits made from forex transactions. Indirect tax meanwhile could be the Goods and Services Tax GST Securities Transaction Tax STT or stamp duty. The main way to tell if youre in the business of trading in cryptoassets is by looking at.

If youre in the business of trading or dealing in cryptoassets you need to pay income tax on your profits. Unfortunately its a situation where the tax system could be accused of taxing gains in a. Trading or dealing involves buying and selling cryptoassets to make a profit.

Forex trading nz tax. Look through the internet trading forex is mostly treated as income gain. Sharesight makes it easy to calculate gains or losses for share traders in New Zealand with our Traders Tax report.

Campground manager by day. The trading strategy Forex Trendy - Best Trend Scanner - The best forex systems - The best forex indicator Millionaires Of Reddit Reveal Their Secret Tricks. Trader by night Campground owner Glenn.

First-in first-out FIFO First-in last-out FILO Minimise capital gain sell highest priced shares first. Aspiring forex traders might want to consider tax implications before getting started. Enter your email address to get started.

Give Your Loved Ones a Copy Of Our Magazine and Avail Subscription Deals. In addition the country is geographically near the Asia-Pacific region and its close proximity makes it easier for brokers to access the potentially huge market of forex traders xn-. People trade in forex either to try to make a quick profit by betting on the changing value of a currency or to provide certainty about the cost of future foreign currency payments called hedging.

Tax can be complicated but there are some basics that it often pays off to know. New Zealand boasts a relatively strong economy free from the financial turmoil in the West. Ad Fondos del cliente legalmente protegidos - Cuenta demo gratis de 100000.

There are some countries in the world including new zealand. Sharesights Traders Tax report calculates any taxable gains using one of four methods. Despite the fact that New Zealand does not have a Capital Gains Tax there are circumstances where gains made can be taxed as income.

Ad Binomo Forex Broker has been providing online trading services since 2014. If youre a trader that trades daily as your primary source of income you would declare how much you earnt from FX at the end of the financial year and pay income tax on that. Returns can come from purchasing foreign money that will need to be held in a foreign currency bank.

Ad Fondos del cliente legalmente protegidos - Cuenta demo gratis de 100000. Suggest keeping good records of trades in a separate bank account which will make tax time lots easier. If youd like to find out more about Tax On Forex Trading Nz the cookies we use and set your individual cookie preferences please review our Cookie Policy.

Im trying to do online FX trading and really confuse with the tax. Two types of taxes are levied on forex traders - direct and indirect.

Chapter 11 Forex Trading Aud Nzd Spot Forex Example My Trading Skills

Experience Safe Fund Management With Fidelis Feel Secured With Our Segregated Client Accounts Www Fcmforex Co Fund Management Risk Management Fund Accounting

Forex Trading Academy Best Educational Provider Axiory Global

Supply And Demand Trading Strategy The Trends Trading Strategies Trading Quotes Forex Trading Quotes

Download Strike Intraday Breakout Forex Trading System Strategy Forex Trading System Forex Trading Forex System

Which Country Is Best For Forex Trading

Usdcnh Impulse Hints At Further Growth Orbex Forex Trading Blog In 2021 Hints Chart Blog

:max_bytes(150000):strip_icc()/dotdash_final_Why_Interest_Rates_Matter_for_Forex_Traders_Dec_2020-01-6d3057201aec47f1b1d86b60e90c2ce6.jpg)

Why Interest Rates Matter For Forex Traders

Forex Trading Nz Best Forex Brokers Regulation Taxes

Forex Trading Academy Best Educational Provider Axiory Global

350 Likes 9 Comments Mindset Business Success Millionaire Mindest On Instagram I Personally Rec Finance Investing Investing Money Management Advice

Forex Trading Nz Best Forex Brokers Regulation Taxes

Best Forex Brokers 2021 Pros And Cons Uncovered

Forex Trading Strategy Online Forex Trading Forex Trading Forex Trading Strategies

Vantage Fx Review 2022 A Guide For Your Forex Trading

Pin By Dwayne Kerr On Currency Forex Unique Symbols Forex Currency Cool Symbols

/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_Forex_Market_Hours_Dec_2020-01-85c0a7fa11a347f8937001cc596a13cc.jpg)