ny mortgage refinance transfer taxes

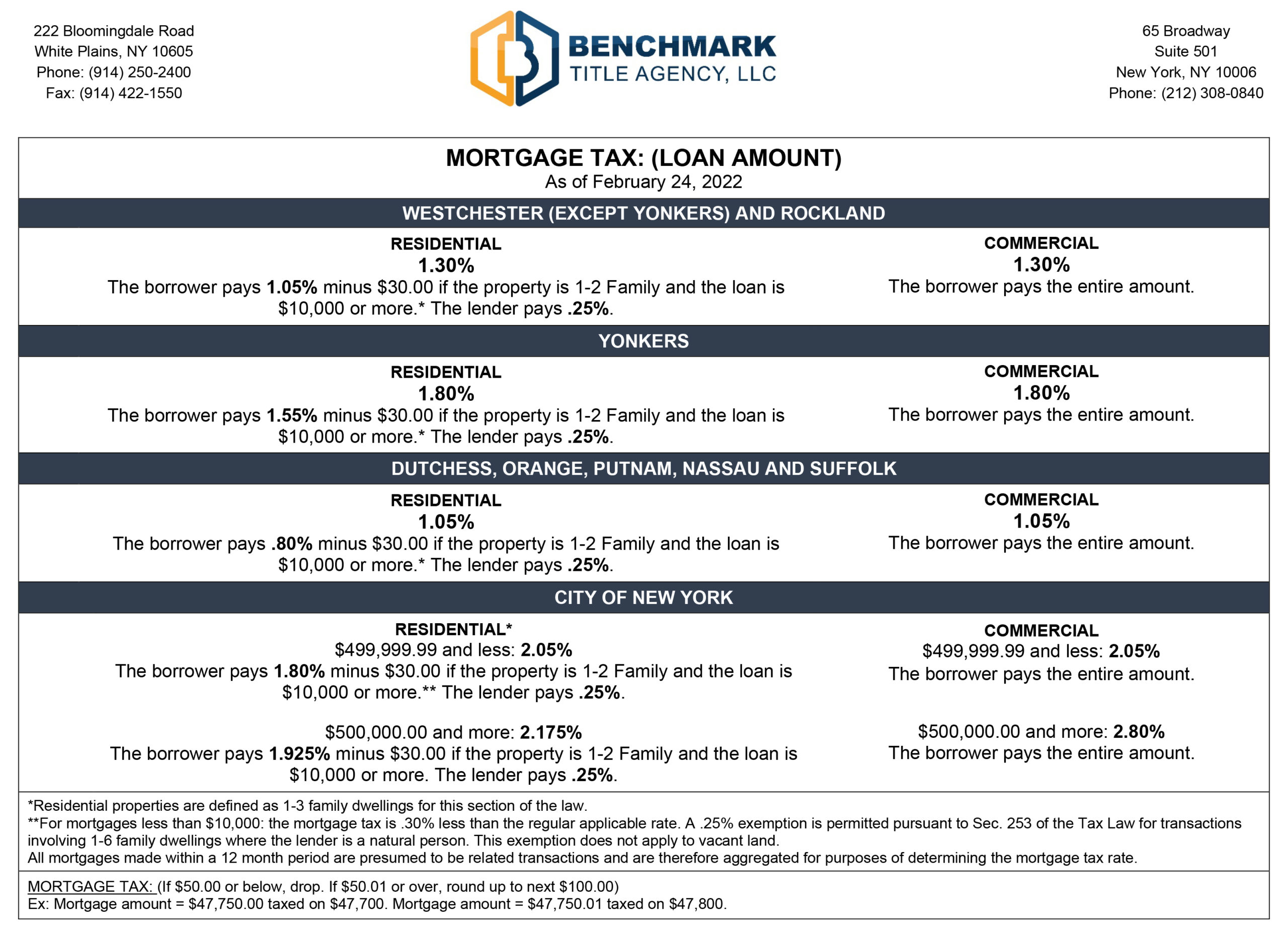

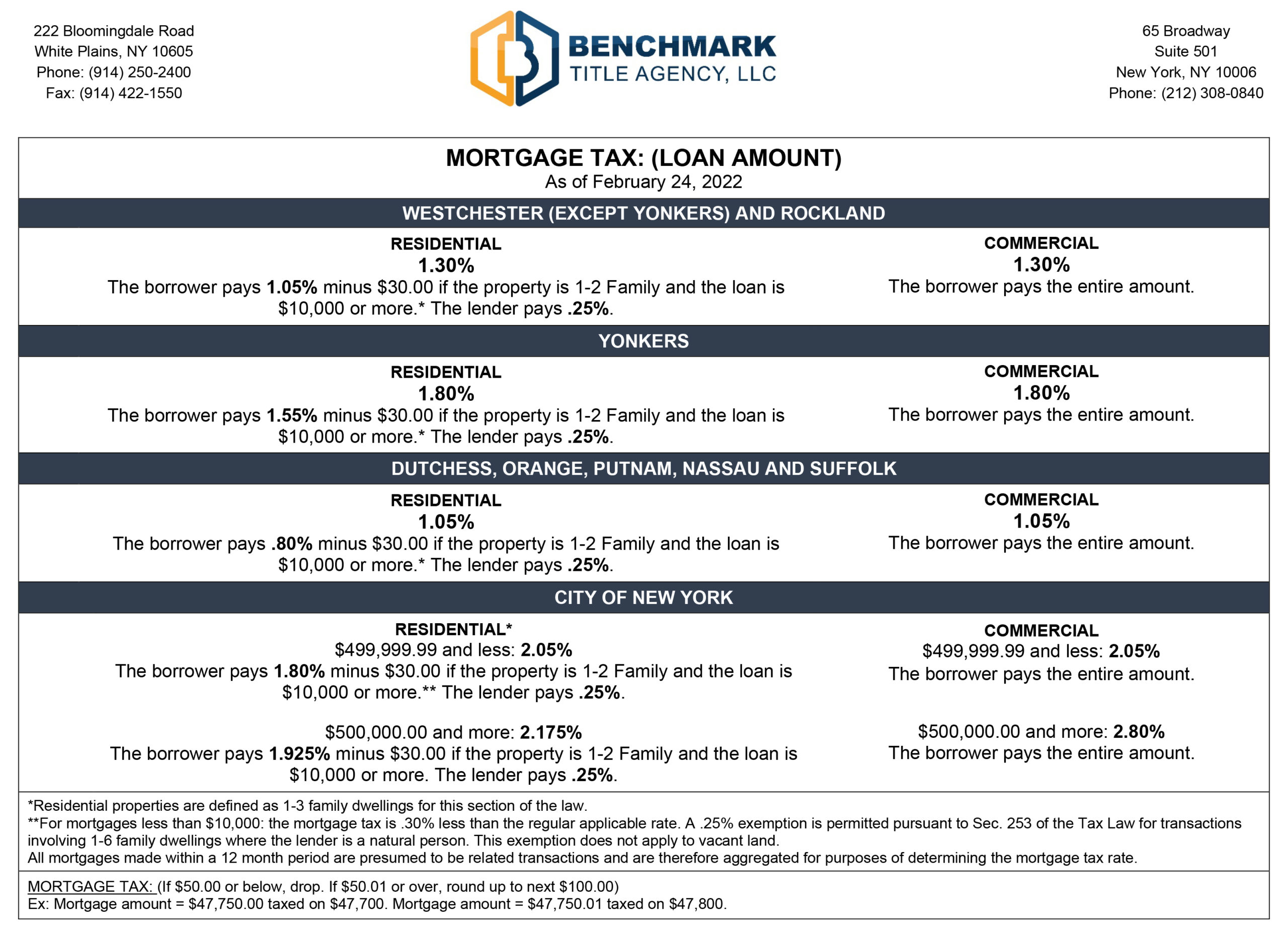

The lender will contribute 25 of the mortgage tax. Lender Doesnt Pay any of the Mortgage Tax.

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Title insurance rates are regulated by the State of New York therefore title insurance rates will.

. Easily calculate the New Your title insurance. Easily calculate the New Your title insurance rate and NY transfer tax. Know when its time to refinance.

Do I have to pay transfer tax on a refinance in NY. If a person is being added to the property deed at the time of refinancing then the person will have to pay the transfer taxes. Lender Pays Part of the.

The tax must be paid again when. New York City Property Original Mortgage. Do you have to pay NYS mortgage tax on a refinance.

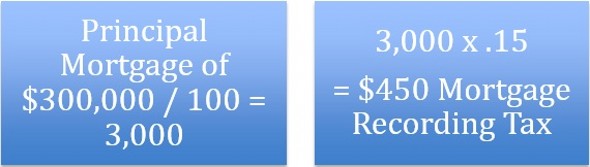

Ny mortgage refinance transfer taxes Wednesday October 5 2022 Edit. For example if you have a 200000 mortgage and are refinancing with a 300000 loan and live in New York City you would ordinarily have to pay a tax of 300000 x 18 percent. Yes the CEMA process allows you to only pay the mortgage tax on the new money.

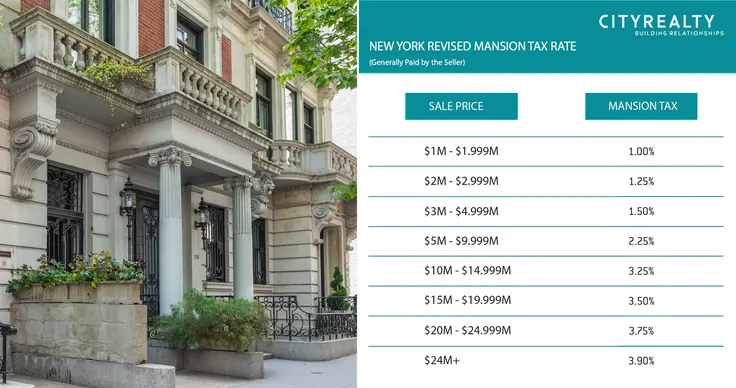

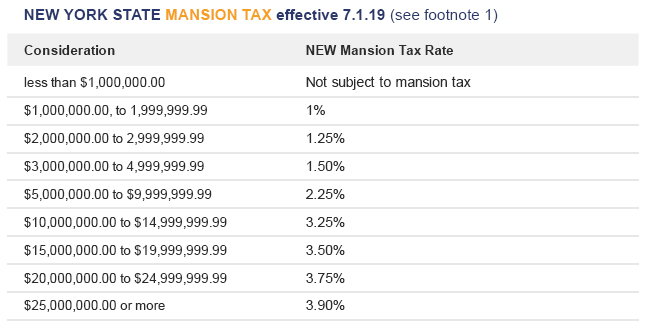

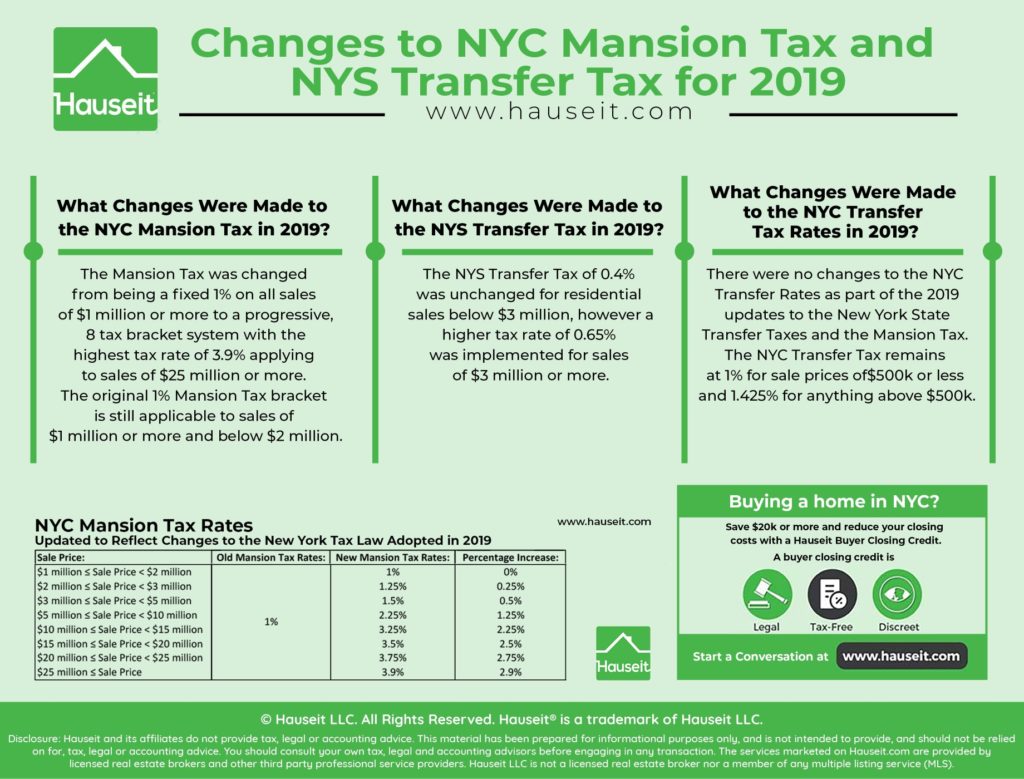

Including the mansion tax. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage. 700000 Refinance Loan Amount.

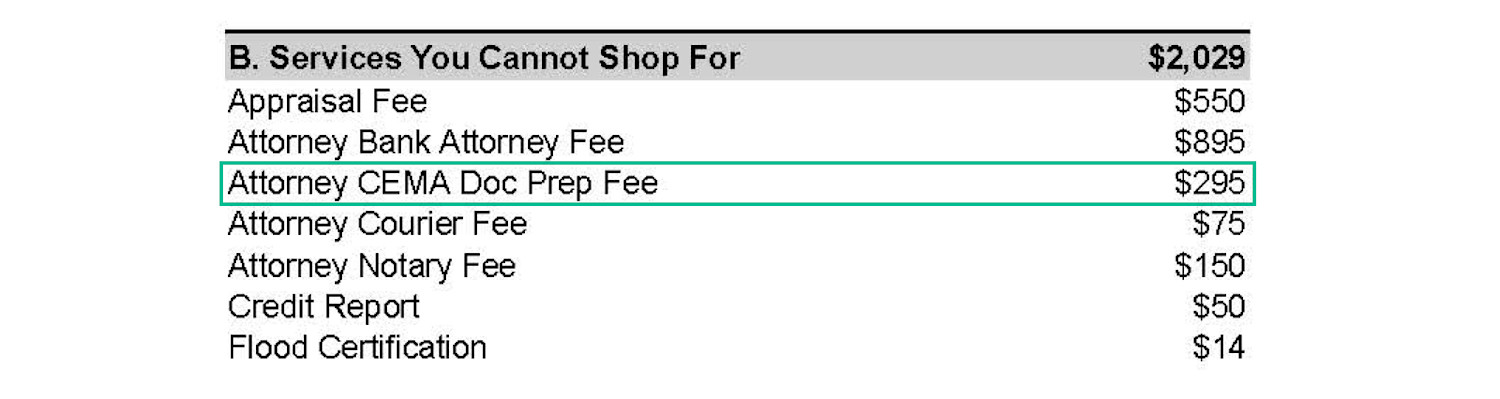

In New York State the transfer tax is calculated at a rate of two dollars for every 500. On a refinance of a 385000 mortgage on a single-family home in Brooklyn the mortgage recording tax would be 6900 for the homeowner and 96250 for the new lender. The difference between the new loan 390000 and the outstanding principal balance of the old loan.

Ad 2021s Trusted Online Mortgage Reviews. 18th May 2010 0533 am. The rate is highest in New York City where borrowers pay 18 percent of the loan.

In New York State the transfer tax is calculated at a rate of two dollars for every 500. The rate varies by county with the minimum being 105 percent of the loan amount. 13th Sep 2010 0328 am.

New York charges a NYS mortgage tax or specifically a recording tax on any new. The NYC Mortgage Recording Tax rate varies between 205 and 2175 however the exact tax differs depending on the size and category of the home mortgage. In a nut shell for residential condominiums and 1-3 family homes when the mortgage is less than 500000 the borrowers portion of the.

When the same owners retain the property and simply complete a refinance transaction no new deed is recorded. Therefore no new deed transfer taxes are paid.

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

What Is A Mortgage Tax Smartasset

A Ny Homeowner S Guide To Cema Loans Cema Loan Better Better Mortgage

Mortgage Tax Transfer Tax Benchmark Title Agency Llc

Reverse Mortgage Foreclosure Lendingtree

What Is A Mortgage Recording Tax Are There Ways To Reduce It

A New Tax For New York S Commercial Real Estate Industry

New York Taxes A Guide To Real Estate Taxes For Nyc Apartment Owners Cityrealty

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

8 Best Mortgage Refinance Companies Of October 2022 Money

A Ny Homeowner S Guide To Cema Loans Cema Loan Better Better Mortgage

Everything You Need To Know About The New Mansion Tax Cityrealty

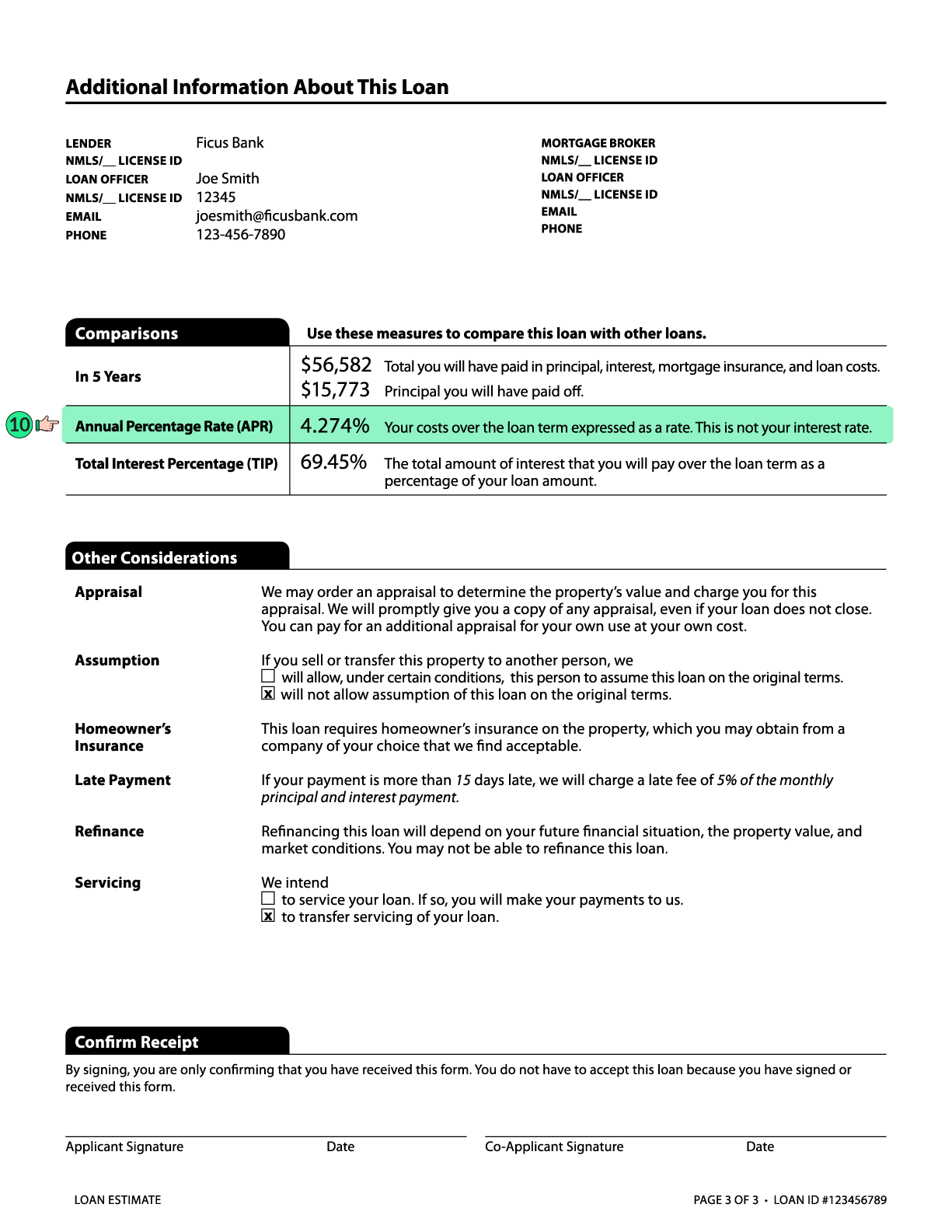

What Is A Loan Estimate How To Read And What To Look For

New Transfer Taxes Passed In Nys Budget Benchmark Title Agency Llc

New York Mortgage Rates Today S Ny Mortgage Refinance Rates

Changes To Nyc Mansion Tax And Nys Transfer Taxes For 2019 Hauseit

A Guide To Understanding Your Closing Disclosure Better Better Mortgage